Government, Finance - CEOs Accidently Admit Trickle Down Is A Sham

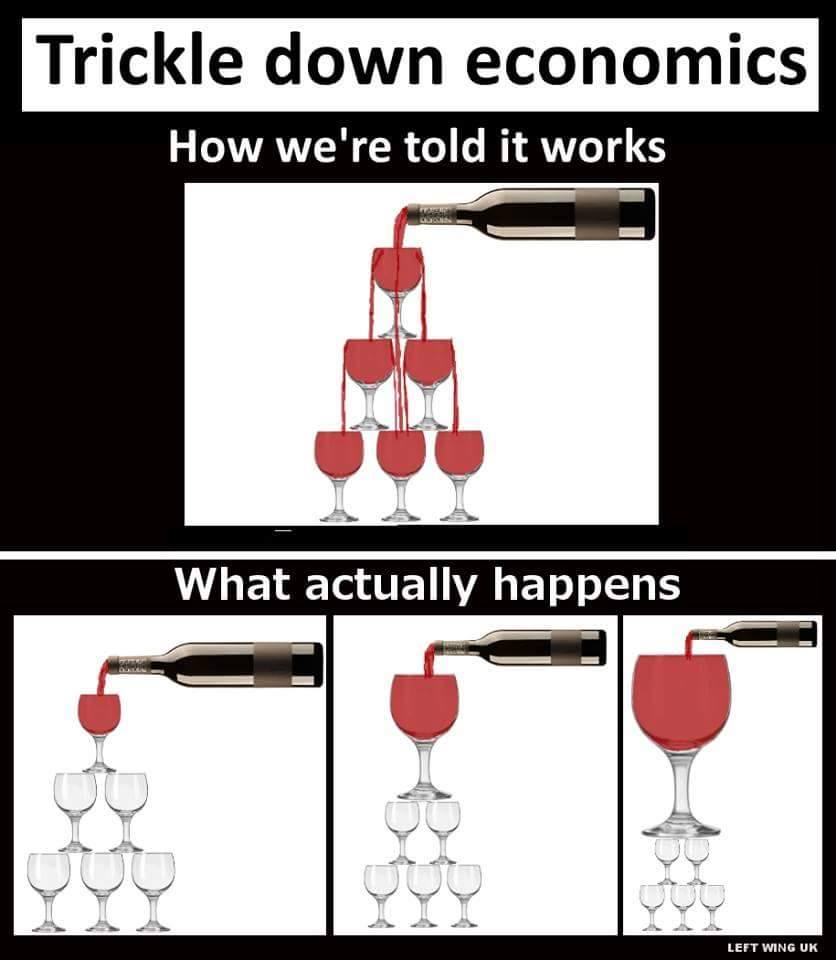

The premise behind conservative "Trickle Down Economic" is that giving tax cuts to the rich and to corporations frees up capital that they will invest in businesses and hire more workers. CEOs looked Donald Trump's economic czar in the face and said, "Nah."

Appearing on stage at the Wall Street Journal's CEO Council meeting, the chief economic advisor to Donald Trump and current Director of the US National Economic Council Gary Cohn talked about the administration's plans to slash the corporate tax rate from 35 percent to 20 percent.

WSJ associate editor John Bussey turned to the dozens of CEOs in the audience, the business leaders in control of the most powerful economy in the world, as asked: "If the tax reform bill goes through, do you plan to increase investment - your companies' investment - capital investment?" And Bussey asked for a show of hands.

Only five signaled they will take the massive windfall that Trump's proposed corporate tax cut will bring and invest it. Only five, and it's not like they were really enthusiastic about it. A bewildered Cohn, apparently still believing that "Trickle Down Economics" is still a thing, sheepishly asked, "Why aren't the other hands up?"

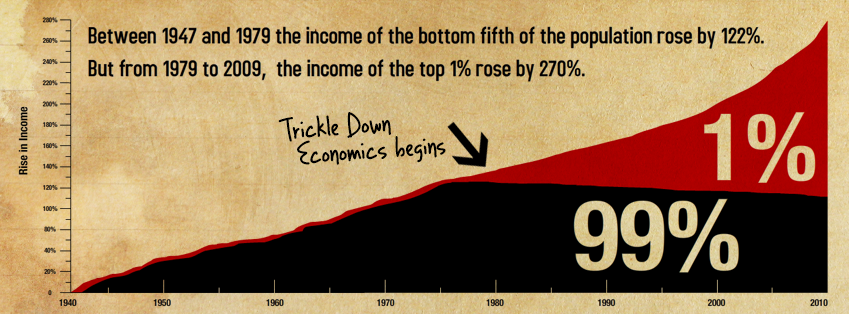

Many Americans without economic degrees and access to popular media platforms have been grumbling for years that the benefits of tax cuts, which began during the Reagan administration in the 1980s, have yet to trickle down to them. Compared to the pre-Reagan economic expansion, incomes are down, debt is up, university is increasingly unaffordable, inequality is at its worst point in many decades.

But recently, even some of the "very serious people" who make or influence US economic policy are admitting that trickle down doesn't work. A National Bureau of Economic Research study published in 2014 found "little evidence that corporate tax cuts boost economic activity" unless implemented in a recession.

US businesses are already enjoying record profits and are awash in cash. If they wanted to invest in new domestic factories and such, they are already capable of doing so even without a tax cut. And a Bank of America-Merrill Lynch survey of 300 CEOs over the North American summer asked what they'd do with the money from a different kind of tax cut, and they overwhelmingly responded they'd pay down debt, buy back company stock to drive up the price, and pursue mergers with other very, very big corporations. Research and Development, and new factories were way, way down on the list. Looking for movers in SF? Best SF and Bay Area Moving Company SF Adams moving. Real reviews.

Create PDF

Create PDF Print

Print Email to friend

Email to friend